A review of the power coal market in 1 and 2015

Since 2015, domestic and foreign economic downward pressure has increased, macroeconomic signs of recovery are not clear, real estate and other downstream steel consumption demand is insufficient. In addition, the state harnessing fog and haze, strengthening environmental protection, and increasing coal limits; nuclear power, hydropower and UHV are developing rapidly, and coal demand continues to decline. Power coal, since 2015, since the 2015, the power coal market is a ill fated market, not only the downward trend throughout the 2014, and the momentum of the fall has been beyond, on the power coal market wind vane ring Bohai power coal price index, from the beginning of the year 525 yuan / ton, down to the current 380 yuan / ton, tired. The decline was 145 yuan / ton, with a drop of up to 27.6%. Compared with last year, the price dropped from 21.2% yuan to 631 yuan / ton in early 14, compared with 497 yuan / ton in the same period last year. Data show that this year, the power coal market has seen a more rapid decline. In view of this year's trend, under the influence of the weak support of downstream demand, coal enterprises to stimulate sales, coal prices have maintained a downward trend, in addition to the early June in early May due to the peak of the summer effect of coal city, a small rebound, the ring finger for two weeks, a small increase, the total range of 4 yuan / ton, but also only the market phase of the Epiphyllum. At present, coal prices have basically maintained a downward trend throughout the year.

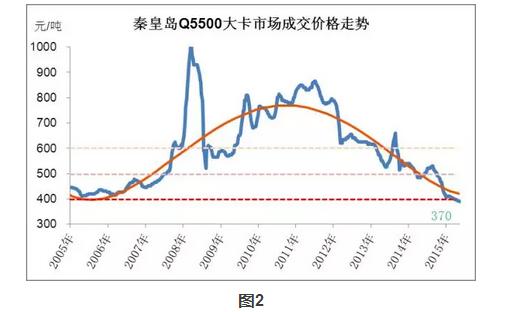

Coal has been playing a key role in the energy structure, of which the most abundant is the power coal. Since 2002, power coal prices began to rise, up to 2009 and 2010, and by the end of 2011, coal prices set a historical record, which was called "ten years of coal gold" in the ten years. However, after the craziness is desolate, "the coal is super crazy" has gone to sell the coal Weng to become "the bad egg". Since 2012, the price of power coal has fallen off the cliff. The coal price of Q5500 big card in Qinhuangdao port has fallen from 860 yuan per ton in 2011 to 370 yuan / ton, which is as high as 56.9%, which is equivalent to cut down. In the last few years, the height of 2013 is 620 yuan / ton, the 2013 low is 515 yuan / ton, the low point in 2014 is 471 yuan / ton, and the low point in 2015 is now 370 yuan / ton. Basically, it broke "6" in 2013, broke "5" in 2014, and broke the "4" rhythm in 2015. As a product with a price of only a few hundred dollars, the annual price drop of more than 100 yuan / ton, such a drop can be said to be very alarming.

2. coal prices plunged, corporate profits shrank and industry losses intensified.

2.1 profit shrinking

As the price of coal plummeted, the profits of coal enterprises are becoming more and more thin. Take the enterprises in Shanxi as an example. According to the statistics of relevant departments, the profits of many coal enterprises have fallen to 2.57 yuan, and a ton of coal can not be bought for a bottle of beverage basically. From the whole industry, we can see that the profit of the coal mining industry shows a declining trend year by year. After 2012, the total profit of coal mining and washing industry has begun to grow negative, and the decline is increasing year by year. In 2012, the decline is -18.12%, and in 2014 it is -46. 47%. In the first 9 months of 2015, the total profit was 28 billion 720 million yuan, a decrease of 64%.

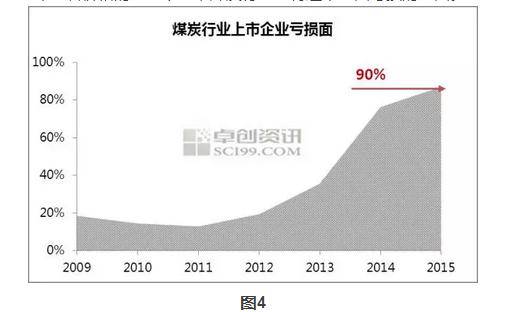

2.2 enlargement of loss surface

In the three quarter of 2015, 90 large enterprises profit 970 million yuan, a year-on-year decline of 97.7% (42 billion 700 million yuan in the same period of the same period last year). According to statistics, the current coal industry has been close to 90% of the loss surface, Zhuo Chuang information is expected to continue to decline with prices in 2016, the coal industry will usher in a comprehensive situation of loss.

3, 2015, the reason why the price of the power coal market is down and down.

Domestic and foreign economic downward pressure is increasing, macroeconomic continues to be weak, and downstream industry demand is weak. In addition, in 13th Five-Year, the plan proposed to strengthen environmental protection efforts, further increase the strength of coal limit; and the replacement of new energy, and so on, so that coal demand continued to decline.

3.1 the output declined, but the decline was reduced.

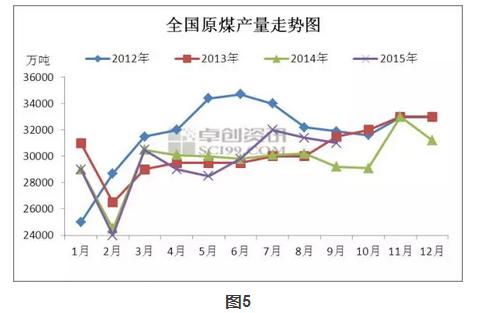

From Figure 5, we can clearly see that the output of raw coal in China did not appear very obvious this year, but from the same year, the output of raw coal in China has fallen continuously since this year. However, in the same period of continuous decline in production, we also found that the decline of raw coal output was narrowing year by year. According to the National Bureau of Statistics, the output of raw coal in January-September 2015 was 273,000 tons, down 4.3% year-on-year; compared with January-June, the decline narrowed by 1 percentage point. The decline was 0.5 percentage points compared to 1-8 months. The decline of raw coal output year-on-year narrowed, reflecting the current coal is still in the passive stage of production. The decline in coal production is largely due to the decline in demand and prices. Some coal enterprises have been forced to reduce the start rate. When the demand for coal is slightly improved, the coal production will soon follow, and the coal market will continue to bear pressure, and the coal industry is difficult to get rid of the former predicament.

3.2 decline in demand

From Figure 5, we can clearly see that the output of raw coal in China did not appear very obvious this year, but from the same year, the output of raw coal in China has fallen continuously since this year. However, in the same period of continuous decline in production, we also found that the decline of raw coal output was narrowing year by year. According to the National Bureau of Statistics, the output of raw coal in January-September 2015 was 273,000 tons, down 4.3% year-on-year; compared with January-June, the decline narrowed by 1 percentage point. The decline was 0.5 percentage points compared to 1-8 months. The decline of raw coal output year-on-year narrowed, reflecting the current coal is still in the passive stage of production. The decline in coal production is largely due to the decline in demand and prices. Some coal enterprises have been forced to reduce the start rate. When the demand for coal is slightly improved, the coal production will soon follow, and the coal market will continue to bear pressure, and the coal industry is difficult to get rid of the former predicament.

3.2 decline in demand

Energy consumption is determined by economic development, and the economic situation determines the total amount of energy consumption. The downward pressure of the economy tests the trend of China's energy economy. Coal accounts for more than 60% of China's primary energy consumption. From Figure 5, we can see that the development of the economy has a greater impact on coal and other energy consumption. The National Bureau of Statistics announced the main economic indicators in the 3 quarter, of which GDP increased by 6.9%. The slow down of the economy determined that the situation of China's energy consumption would be slow down. In recent years, China's economy is in the "three phase" superposition stage of the growth speed shift period, the period of structural adjustment pain, and the digestion period of the early stimulus policy, and the short term economy still faces great downward pressure. China's Manufacturing Purchasing managers'index (official PMI) in August, released by the National Bureau of Statistics, was 49.7%, the first time since March this year that it fell below the ebb and flow line. In September, the initial purchasing managers index (Caixin PMI) of Caixin manufacturing industry in China was 47%, falling to a low point in more than six years. Official PMI and new financial PMI both fell below the 50% boom and bust line, meaning the overall manufacturing sector continues to shrink, energy and raw material demand will be restrained. In addition, as an important engine of economic growth for many years, investment in real estate development has become increasingly weak. In 1-9 months, the growth rate of investment in real estate development dropped to 2.6%, the lowest in the same period since 1998.

3.4 coal enterprises are in high stock

As the overall demand for coal continues to be weak, the process of coal to capacity is slow, the situation of loose coal supply and demand is difficult to change in the short term, and the coal market continues to weaken. In this case, the downstream users generally adopt a low inventory strategy, since this year, coal stocks in the main coal industries, such as electricity, have declined significantly. In September 20th, the coal stock of the national key power plant was 61 million 820 thousand tons, down by 29 million 30 thousand tons at the beginning of the year, down by 29.6%, down by 12 million 630 thousand tons from the same period last year, and down by 15.9%. At the same time, at the same time, the terminal users continue to carry out the low inventory strategy, and the transfer of the stock has also declined to some extent this year, but the stock of coal enterprises has always maintained high, and the coal enterprises are always facing greater stock pressure. By the end of 7, the data showed that the total of 59 million 160 thousand tons of coal stock in state key coal mines was 59 million 160 thousand tons, up 11 million 90 thousand tons from the beginning of this year, up 23%, up 2 million 880 thousand tons from the same period last year, and increased by 5.2%.

Coal market outlook at the end of 4.2015 years and 2016

4.1 hard to change the weak trend of coal demand

In the four quarter of 2015, it will gradually enter the peak of coal heating in winter. Compared with the earlier period, the demand for coal purchasing of the end users of electricity and heat is likely to pick up slightly. But even so, coal demand is still hard to change.

On the one hand, short-term downward pressure on the economy is still large, coal demand will continue to be suppressed. On the other hand, the rapid development of alternative energy will also curb coal demand to a certain extent. In recent years, with the steady advancement of energy production and consumption revolution, the rapid development of renewable or clean energy, such as hydropower, wind power, nuclear power, photovoltaic and so on, has affected coal consumption in varying degrees. In addition to the above clean or renewable energy, as the government's efforts to promote the development of low-carbon energy, natural gas will gradually form a more alternative to coal. Considering the above factors and the uncertain expectation of the market in 2016, Zhuo is expected to continue the weak demand trend of the power coal market in 2016.

4.2 coal production continued a small decline

Due to the rapid growth of domestic coal demand in the past more than 10 years and the continuous rise of coal prices, many new coal projects have been launched. However, many new coal projects have not yet come into production, China's economic development has entered a new normal, economic growth rate slowed, economic structure adjustment accelerated, the intensity of energy demand weakened, the recent two years even the coal demand decreased in varying degrees, eventually leading to serious overcapacity in the country's coal production capacity. In the past two years, in the case of serious overcapacity in domestic coal production capacity and the plight of the coal industry, although the relevant departments are also increasing their efforts to eliminate backward coal production capacity, the relevant departments have also issued a number of documents to increase production supervision and control, to curb illegal, Supercapacity and unsafe and uneasy production, but the excess capacity is withdrawn from the machine. The system is not perfect, and a large number of state-owned coal enterprises are less flexible in operating flexibility, the reaction to the market is slow, and the serious overcapacity situation of coal production has not been fundamentally changed. Chuang Chuang believes that coal production will increase at any time as demand changes in the short term. Considering that the four seasons of 2015 will gradually enter the peak of winter heating coal, coal demand, especially the demand for power coal may rise seasonally, and coal production in the four quarter is expected to increase in the first three quarters. However, the forecast for the market in 2016 is relatively low. As the overall coal demand is weak, it is expected that the output of coal will also be difficult to increase significantly, which will continue a slight decline.

4.3 coal prices or will continue to wander low

Although after a long period of decline, the current coal price has been at a low level, more and more enterprises have fallen into losses. However, due to the continued low demand for coal, excess coal production capacity can not be effectively resolved, low coal prices hovering or will become the norm. In addition, it is worth noting that, although the current coal price has been very low, but the coal industry has not been in the whole industry loss, there are still some resources, low cost coal enterprises or mine can be profitable. In the case of oversupply of coal, the cost of these enterprises may be the ultimate bottom line of coal prices. Therefore, it is expected that coal prices will continue to fall easily in the short run. Even if the increase in short-term demand leads to a rise in coal prices, the rapid release of production will also inhibit the rise in coal prices, and if supply and demand disequilibrium will even lead to a further decline in coal prices. All in all, low wandering should be the main keynote of the fourth quarter coal price trend. In 2016, coal prices still had room to fall, but there would be no such decline in the past two years. Before the overall demand is still weak and excess capacity has not been effectively resolved, do not expect a substantial increase in the price of coal, which may fall deeper after a substantial increase.